Hey mama! If you’re preparing to start homeschooling (or just took the leap), this post is here to help you get your footing—and save some money along the way.

I’m sharing everything I wish I had when I started:

✅ A free Homeschool ID you can personalize

✅ A list of teacher discounts that homeschoolers can claim

✅ Grants and scholarships to help fund curriculum, activities, or even sports

✅ Plus, an intro to Idaho’s new Parental Choice Tax Credit that can refund up to $5,000 per student (yes—really!) Read the full post here.

Let’s dive in and get you feeling confident and equipped for this journey.

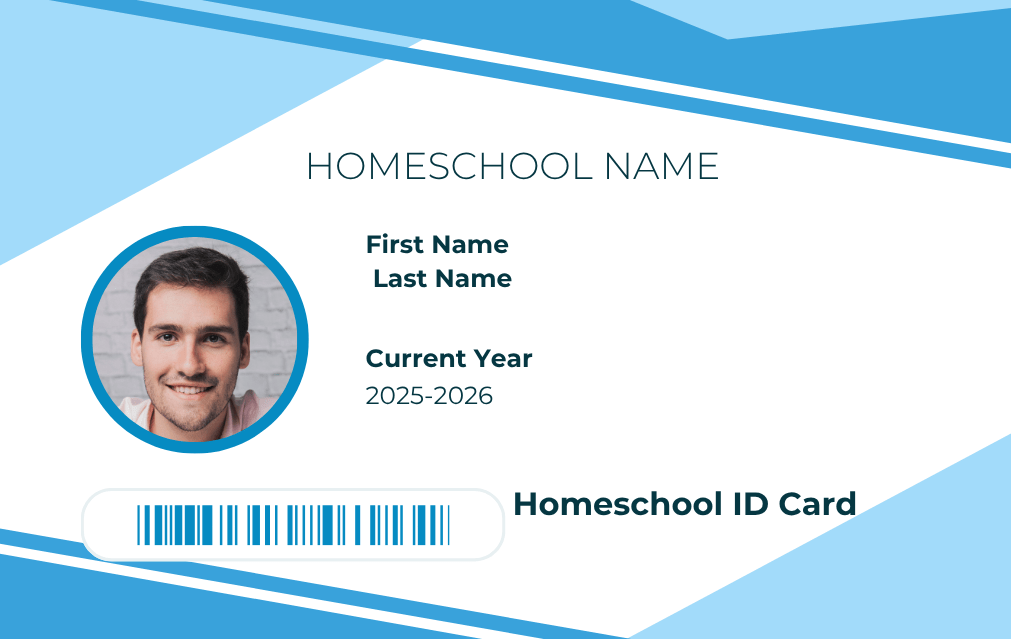

🎓 1. Create Your Homeschool ID (FREE Canva Template)

Many teacher discounts require an educator ID—and yes, you can make one as a homeschooler! I’ve linked the customizable Canva template for you to personalize and print at home. Simply select one of their free templates and input your personal information.You can even laminate it if you want to keep it in your purse for in-store use. When shopping, especially for school related supplies, ask if they offer a discount for home educators!

Seems a little odd that we can create our own ID’s, I know! But there is no official, one place to get a homeschool ID issued.

You’ll want to include:

Homeschool Name (yes, you can give your own homeschool a name)

Your name

The current school year

Here is an example

👉 Click here to open the Homeschool ID templates in Canva

Tip: Add your homeschool name, your photo, and the current year.

🛍 2. Use Your Homeschool ID to Unlock Teacher Discounts

Yes—you qualify for educator discounts at many major retailers. Some will ask for proof (your ID, a declaration of intent, or SheerID verification), while others accept homeschooler status without much fuss.

Every establishment and organization will be different. Several months ago I saw on IG that you could get the teacher discount through Target 🎯- with the discount available after approved by SheerID.

So I tested it. I submitted my ID and was denied. The conflict I was having was Idaho, my state of residence, does not issue any formal documentation to homeschool parents/students. And this is what target requires. Here’s what I did.

I contacted SheerID via email customer support and explained the situation. They were very helpful! When you are trying to get verified through a company that uses SheerID as the verifying co., you’ll need to contact SheerID, not the retailer.

Customer support had a few other options for documents that I could submit that were not able to be verified by the bot that does the initial verification.

Through customer support I was able to send them screen shot receipts of homeschool curriculum I had purchased. They approved it within a couple of days and now I can get my teacher discount through the target 🎯 circle app!

Not every retailer with SheerID verification is asking for the same documents some of mine have been verified simply by signing up. Also, not every retailer allows homeschool discounts. Some are for certified teachers only. It just takes a little weeding through. But if there’s a retailer you use frequently, it’s worth checking into!

Here’s a handy list of retailers that offer teacher discounts 👇

| Retailer | Discount | Verification Method | Online Link |

|---|---|---|---|

| Target | 15–20% off back-to-school | Target Circle + SheerID | Target Teacher Sign-Up |

| Michaels | 15% off anytime | Michaels Rewards account + Educator status | Michaels Rewards |

| Sheer ID | Offer varies | Teacher Discounts to multiple stores | Sheer ID Deals |

| Books-A-Million | 20% off | Educator card (homeschoolers accepted) | Books-A-Million Educator Program |

| Half Price Books | 10% off | Homeschool ID accepted in-store | Half Price Books Educator Discount |

| Apple, Microsoft, Adobe | Varies (~10–40%) | SheerID or educator verification | Apple, Microsoft, Adobe |

💰 3. Grants & Resources That Help Homeschoolers

Homeschooling doesn’t always come with a school budget—but that doesn’t mean there’s no help out there. These national grants and scholarships can help cover curriculum, supplies, testing, sports, co-op classes, and more.

Many states in the USA have some type of program in place to help with school choice funding. EdChoice.org provides a list of all the states and the current legislation in place to assist school funding. Many states have ESA (education savings accounts), we can hope that all follow suit! Still waiting for Idaho to pass legislation for one.

529 College Savings Plans: While primarily designed for college, some states allow 529 funds to be used for qualified K-12 expenses, including some homeschooling costs. The states that I could find that allow this are Alaska, Indiana, Kansas, Kentucky, & Texas.

Depending on the state, your homeschool child may participate in public school for electives and sports. Every state has different laws regarding this. You can find those here.

| Program | What it Funds | Application Timeline | Link |

|---|---|---|---|

| Dailies Foundation | Financial support for homeschoolerr | Periodically 6-9 week approval process | Apply Here |

| HSLDA Compassion Grants | Curriculum, tutoring, testing, special needs | Rolling; must be a member | HSLDA Grants |

| HSLDA Group Grants | Funding for co-ops or homeschool groups | Once/year | Apply Here |

| Kids in Need Foundation | School supplies (K–12) | Periodically | KINF Website |

| All Kids Play Sports Grants | Youth sports & registration fees | Seasonal | All Kids Play |

| Ambleside Schools Fund | Charlotte Mason curriculum scholarships | Annual | Ambleside Schools |

| Scholarships for Homeschooled Seniors | College tuition & aid | Various | The Scholarship System |

🧾 4. Track Your Homeschool Expenses (Free Printable)

Since many grants (and even tax credits!) require you to keep receipts, it’s a good idea to begin tracking now—even if you’re not sure what you’ll apply for yet.

👉 Download the Homeschool Expense Tracker Printable

Print a page for each month and jot down what you spend on:

- Curriculum

- Subscriptions

- Co-op classes

- Sports or music lessons

- Supplies

- Internet or learning tech

💡 5. Idaho Families—There’s a Tax Credit Just for You

If you’re an Idaho homeschooling family, you really want to know about this:

👉 Idaho’s new Parental Choice Tax Credit (link to your tax credit blog post)

This credit refunds up to $5,000 per child for educational expenses—including curriculum, tutoring, online programs, supplies, and more. Applications open January 2026, and it’s available to all Idaho families (priority given to lower-income).

I wrote a full breakdown of who qualifies, how it works, and what you need to do now. Read it here →

💛 You’re Doing Great, Mama

Whether you’re feeling excited, overwhelmed, or both—I’m cheering you on. Homeschooling is a beautiful way to reclaim your family’s time and tailor learning to your kids. And while it’s not always easy, you don’t have to figure it all out alone.

Start with these free tools, track your expenses, take advantage of educator discounts, and explore funding that fits your family. You’ve got this.

Have questions or want more resources like these? Leave a comment below or subscribe to my newsletter to get updates, printables, and encouragement delivered straight to your inbox.

✅ Resource Recap

- 🎓 Free Homeschool ID Template (Canva)

- 🧾 Homeschool Expense Tracker Printable

- 💡 Learn About Idaho’s $5K Tax Credit for Homeschooling

- State by State funding